This post may contain affiliate links, which means I'll receive a commission if you purchase through my link at no extra cost to you. Please read my disclaimer for more details.

Please note that I am not a professional of any kind so any information in this post is not meant to be medical, legal, financial, relationship or any professional advice.Wanna know the habits of women who are never broke? We did too! These are some of the best habits of women who always have money!

I’m sure we would all like to know habits of women who are never broke!

That’s why we found some of the best money tips and ways to save money!

Whether you are looking to save money, make money, or know how to manage money, we’re sure you’ll find this list helpful!

This post is all about habits of women who are never broke.

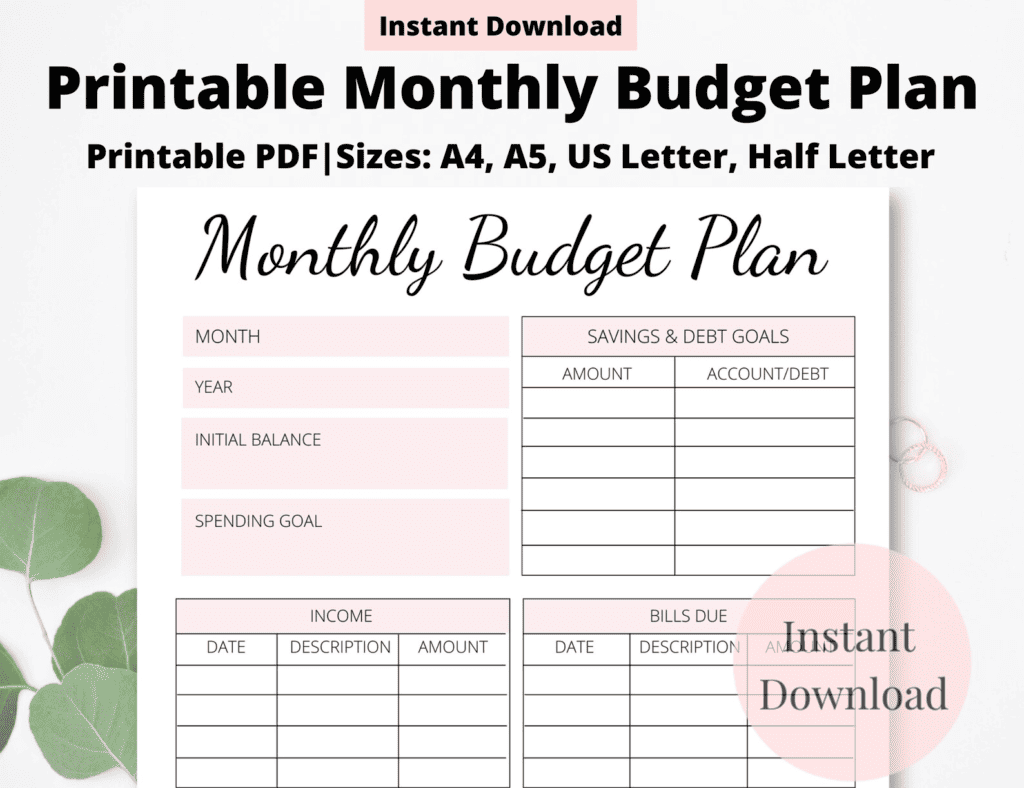

1. Budget, Budget, Budget

This is probably the most important habits of women who are never broke.

You know the saying “if you fail to plan, you plan to fail”? It’s totally true, especially when it comes to finances.

If you don’t know where your money is going then it’s a good idea to set up a budget. If you don’t give your money a place to go, then trust me, it’ll get spent fast.

You don’t need a fancy personal finance app, just use a spreadsheet on your computer or even just write it in a notepad.

If you like to use something a bit more structured, I’ve made a printable monthly budget plan you can see below. This can really help you budget easily and keep your finances organized.

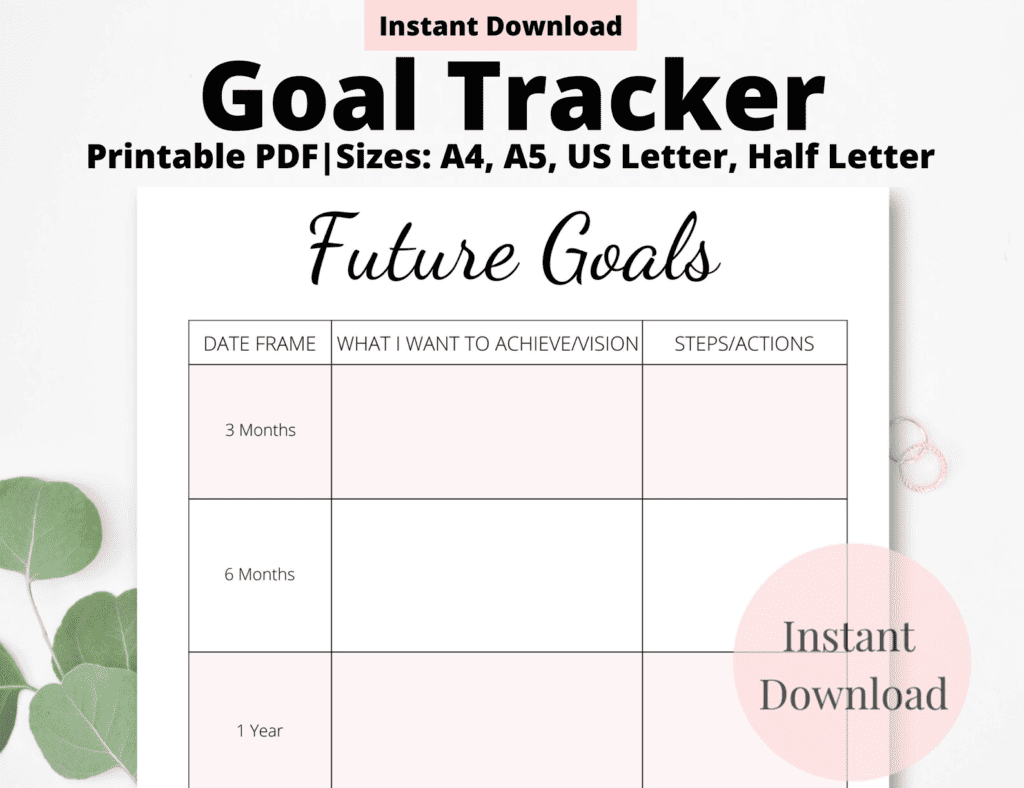

2. Set goals

You should always be setting up goals for yourself but especially when it comes to your finances.

It can be hard to stay motivated to spend less and save if you don’t have clear financial goals in mind.

Try writing out some financial goals and have it posted somewhere where you can see them daily.

I also have a goals planner that can help you write out and organize your goals.

3. Prioritize

A good money habit to have is the ability to be able to prioritize your spending.

This is not to say you can’t treat yourself once in awhile, but you want to get in the habit of reminding yourself what’s important.

Reminding yourself of your goals can help you prioritize as well.

4. Limit shopping

I am all for going shopping and treating yourself once in awhile.

But if you make it a habit to go to the mall every weekend, then you’ll likely end up spending more than you’d like to.

Try to limit your shopping and find another hobby that you enjoy.

If you don’t want to cut out shopping altogether then you could always treat yourself to one small item a month if you’re budget allows.

RELATED POST: 11 EASY AND FUN TIPS ON HOW TO KEEP YOURSELF BUSY

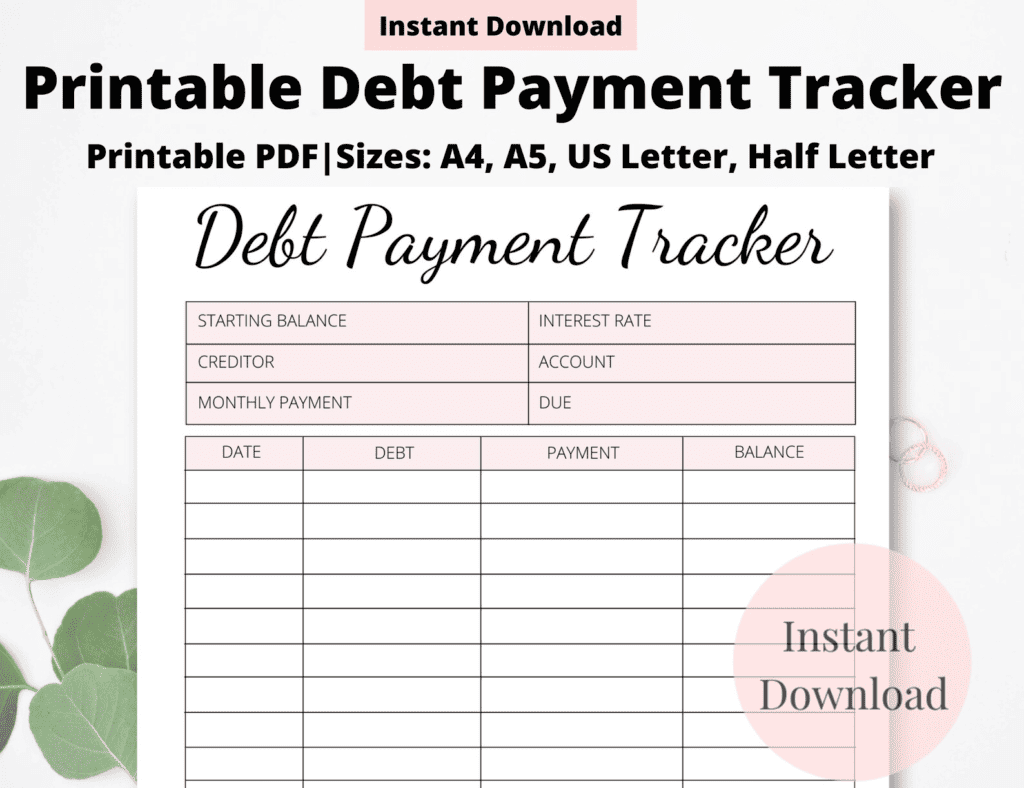

5. Get out of debt

This can be one of the hardest habits of women who are never broke but probably one of the most important.

It can be SOO difficult to get out of debt. But if you stay in debt then it’ll take you that much longer to get ahead.

Try cutting out expenses so you can put extra money towards your debt, even a little goes a long way.

I’ve created a printable debt payment tracker to make organizing and tackling your debt easier.

6. Live below your means

When looking at your budget, see what you have leftover that you can spend and try your hardest not to go above that.

Find hobbies that you enjoy and that aren’t expensive.

If you like going out to restaurants try cutting back or go out for coffee instead.

RELATED POST: 25 CHEAP DATE NIGHT IDEAS THAT DON’T SUCK!

7. Save

Try your hardest to find money in your budget that you can save, even if it’s just a little bit.

It’s always a good idea to have a bit of money saved up for emergencies and it’ll make you feel more confident about your personal finance.

8. Multiple streams of income

There are tons and tons of side hustles out there and earning a bit of money on the side can make a world of difference.

Try searching different side hustles and see which one interests you.

They can seem super overwhelming at first, but if you find an idea you like, just try and take 15 minutes a day to learn about it.

Many successful entrepreneurs started off this way.

9. Lower your expenses

When you create your budget, see if there are any extra expenses you could cut out.

Are there any subscriptions you could live without? Are you spending just a bit too much on take out? Do you get your hair and nails done every week?

When you cut out expenses you can use that money to pay off debt or save.

RELATED POST: BEST NAIL TOOLS FOR AMAZING DIY NAILS

10. Have a positive money mindset

Lastly, an important habit of women who always have money is to have a positive mindset about it.

That can seem easier said then done when you are struggling financially, but try to change your mindset to abundance.

Try to focus more on what you do have, rather then what you don’t.

And think of money as something that can come easily and become excited about searching different ways to make money.

Leave a Reply